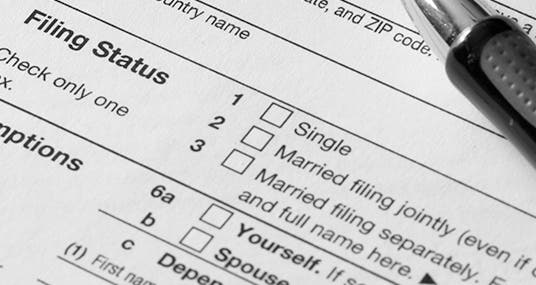

How are different consumption taxes related? How do taxes affect income inequality? The deductions from your paycheck are only half the story of payroll taxes. How would the tax system need to change with return-free tax filing? How does the earned income tax credit affect poor families? To make up the difference, the Treasury borrows money by issuing bonds.

Stay Connected

Government revenue is the money received by a government from taxes and non-tax sources to enable it to undertake government expenditures. Government revenue as well as government spending are governmsnt of the government budget and important tools of the government’s fiscal policy. Seignorage is one of the ways a government can increase revenue, by deflating the value of its currency in exchange for surplus revenue, by saving money this way governments can increase the price of goods too far. From Wikipedia, the free encyclopedia. Public finance Policies.

Where does the government get the money it spends?

The income tax is just one part of the equation, though. One need not be the owner of a corporation to pay corporate taxes. When a business pays out taxes, the customers and employees also pay in terms of lower wages and more expensive goods. One need not be an importer to pay tariffs, which end up costing consumers more in terms of more expensive goods and fewer goods available to them. And one need not be a driver of automobiles in order to pay the federal excise tax on gasoline. Every good and service that relies on gasoline for transport costs us more thanks to that tax.

Where Does the US Government Get Its Money?

Government revenue is the money received by a government from taxes and non-tax sources to enable it to undertake government expenditures. Government revenue as well as government spending are components of the government budget and important tools of the government’s fiscal policy. Seignorage is one of the ways a government can increase revenue, by deflating the value of its currency in exchange for surplus revenue, by saving money this way governments can increase the price of goods too far.

From Wikipedia, the free encyclopedia. Public finance Policies. Fiscal policy. Monetary policy. Bank reserves requirements Discount window Gold reserves Interest rate Monetary authority central bank currency board Monetary base Monetary currency union Money supply.

Trade policy. Revenue Spending. Non-tax revenue Tax revenue Discretionary spending Mandatory spending. Balanced budget Economic growth Price stability. Fiscal adjustment Monetary reform. Categories : Fiscal policy Government stubs Finance stubs. Hidden categories: Wikipedia articles incorporating a citation from the Encyclopaedia Britannica with Wikisource reference All stub articles. Namespaces Article Talk. Views Read Edit View history. By using this site, you agree to the Terms of Use and Privacy Policy.

Monetary policy Bank reserves requirements Discount window Gold reserves Interest rate Monetary authority central does government make money form taxes currency board Monetary base Monetary currency union Money supply.

Optimum Balanced budget Economic growth Price stability. Reform Does government make money form taxes adjustment Monetary reform. This government-related article is a stub. You can help Wikipedia by expanding it. This finance -related article is a stub.

Adam Ruins Everything — The Real Reason Taxes Suck (And Why They Don’t Have To) — truTV

Apply for tax relief before you get taxed on foreign income

How would various proposals affect incentives for charitable giving? Down the road, however, the Treasury must pay back the money it has borrowed, and pay interest as. Distribution of Tax Burdens How are federal taxes distributed? TurboTax is the 1 rated «easiest to use» and the «tax software with the best advice and options»: Based on independent comparison of the best online tax software by TopTenReviews. Now that you have a does government make money form taxes understanding of the debt, we at CED urge you to look at more of our work on specific solutions ranging from changes to our health care system to tax reform to regulatory changes, all of which we believe will improve our dire debt condition. TurboTax Deluxe searches more than tax deductions and credits so you get your maximum refund, guaranteed. What are defined contribution retirement plans? Taxes and the Economy How do taxes affect the economy in the short run? If the US is not bringing in enough money, primarily through taxes, then our deficits, and ultimately our debt, will be large and will grow. Would tax evasion and avoidance be a significant problem for a national retail sales tax?

Comments

Post a Comment