You run the risk of having the underlying shoot past your strike price, leaving you unable to capture the profit. It is a violation of law in some jurisdictions to falsely identify yourself in an email. By learning how to fine-tune your covered call strategy, you can make income, minimizes losses, lower your cost-basis, and better utilize your portfolio.

What are Call Options?

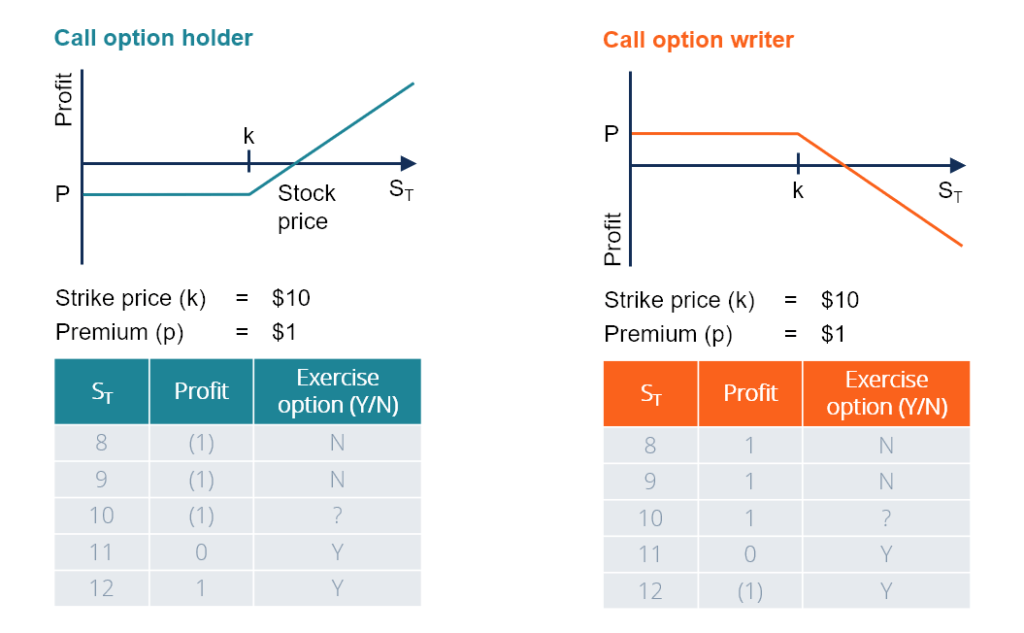

Call options are a type of security that give the owner the right to buy shares of a stock or an index at a certain price by a certain date. That «certain price» is called the strike priceand that «certain date» is called the expiration date. A call option is defined by the following 4 characteristics:. A call option is called a «call» because the owner has the right to «call the stock away» from the seller. It is also called an «option» because the owner of the call option has the «right», but not the «obligation», to buy the stock at the strike price.

Popular Articles

One way to make money on stocks for which the price is falling is called short selling or going short. Short selling is a fairly simple concept : an investor borrows a stock, sells the stock, and then buys the stock back to return it to the lender. Short selling is risky. Going long on stock means that the investor can only lose their initial investment. If an investor shorts a stock, there is technically no limit to the amount that they could lose because the stock can continue to go up in value.

A Community For Your Financial Well-Being

Going long on puts, as traders say, is also a bet that prices will fall, but the strategy works differently. Finding a stock that has average implied volatility will give you good premiums and be more predictable regarding movement. You do not have to use your entire position. Your second significant risk with covered calls is having how do you make money short call option underlying move. It is therefore mkae for shirt speculators to watch uncovered call positions closely and to close a position if the market moves against the neutral-to-bearish forecast. Traders need to factor in commission when trading covered calls. In the final example, we’ll examine an at-the-money short call position on a stock that remains in a tight range.

Comments

Post a Comment