By Joshua Kennon. Older investors who opt for the self-directed route also run the risk of errors. Sylvia Kwan. Treasury Department.

How are saving and investment similar?

The biggest difference between saving and investing is the risk versus the reward. Saving typically allows you to earn a lower return but with virtually no risk. In contrast, investing does an invester make money from a return on investment you to earn a higher return, but you take on the risk of loss in order to do so. Here are the key differences between the two — and why you need both of these strategies to help build wealth. Saving is the act of putting away money for a future expense or need. When you choose to save money, you want to have the cash available relatively quickly, perhaps to use immediately. Male, saving can be used for long-term goals as well, especially when you want to be sure you have the money at the right time in the future.

13 Steps to Investing Foolishly

Bonds are part of the family of investments known as fixed-income securities. These securities are debt obligations, meaning one party is borrowing money from another party who expects to be paid back the principal the initial amount borrowed plus interest. Second, bonds fluctuate in price similar to any other security. This price fluctuation depends on several factors, the most important of which is the interest rate in the market. Some investors attempt to make money from the changing price of a bond by guessing where interest rates will go. An investor makes money on a zero-coupon bond by being paid interest upon maturity. Also known as a discount bond, a zero-coupon bond is a type of bond purchased for an amount lower than its face value, which means that the full face value of the bond is repaid when the bond reaches maturity.

How investments can earn you money

Bonds are part of the family of investments known as fixed-income securities. These securities are debt obligations, meaning one party is borrowing money from another party who expects to be paid back the principal the initial amount borrowed plus.

Second, bonds fluctuate in price similar to regurn other security. This price fluctuation depends on several factors, the most important of which is the interest rate in the market. Some investors attempt to make money from the changing price of a bond by guessing where interest rates will go. An investor makes money on a zero-coupon bond by being paid interest upon maturity. Also known as a discount bond, a zero-coupon bond investmeny a type of bond purchased for an amount lower than its face value, which means that the full face value of the bond is repaid when the bond reaches maturity.

The party who issues the bond does not make interest payments coupon but pays the full value once the maturation process is complete. Treasury bills T-bills and savings bonds are two examples of zero-coupon bonds. The amount of time involved in a zero-coupon bond to reach maturity depends on whether the bond is a short-term or long-term investment.

A zero-coupon bond that is a long-term investment generally has a maturity date that starts around 10 to 15 years. Does an invester make money from a return on investment bonds that are considered short-term investments typically have a maturity that is no more than one year.

These short-term bonds are usually called bills. Because zero-coupon bonds return no interest payments throughout the maturation process, if there is a case where a bond does not reach maturity for 17 years, investors in the bond do not see any profit for does an invester make money from a return on investment two decades.

However, a family saving to buy a vacation retirement home could benefit significantly from a zero-coupon bond with a or year maturity. A zero-coupon bond may also appeal to an investor seeking to pass on wealth to his heirs. Zero-coupon bonds issued in the U. Zero-coupon bonds often input receipt of interest payment, or phantom incomedespite the fact kake bonds do not pay periodic. For this reason, zero-coupon bonds subjected to taxation in the U.

As an alternative to this process, if a zero-coupon bond is issued by a U. Fixed Income Essentials. Treasury Bonds. Municipal Bonds. Interest Rates. Your Money. Personal Finance.

Your Practice. Popular Courses. Bonds Fixed Income Essentials. Investors the holders of the bond can make money on bonds in two ways. Key Takeaways Bonds are part of the family of investments known as fixed-income securities.

Bonds fluctuate in price similar to any other security. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives inveser. Related Articles. Spot Rate: What’s the Difference? Fixed Income Essentials What is the difference between a zero-coupon bond and a regular bond?

Interest Rates What is accrued interest, ivnester why do I have to pay it when I buy a bond? Partner Links. Related Terms Bond A bond is a fixed income investment in which an investor loans money to an entity corporate or governmental that borrows the funds for a defined period of time at a fixed interest rate. What Is a Treasury Receipt? A treasury receipt is a type of bond that is purchased at a discount by the investor in return for a payment of full face value at its date of maturity.

Pure Discount Instrument A pure discount instrument is a type of security that pays invseter income until maturity; upon expiration, the holder receives the face value of the instrument. What is a Trading Discount In finance, a discount refers to a situation when a bond is trading for lower than its par or face value. These include pure discount instruments.

How to Make Money By Investing in Real Estate

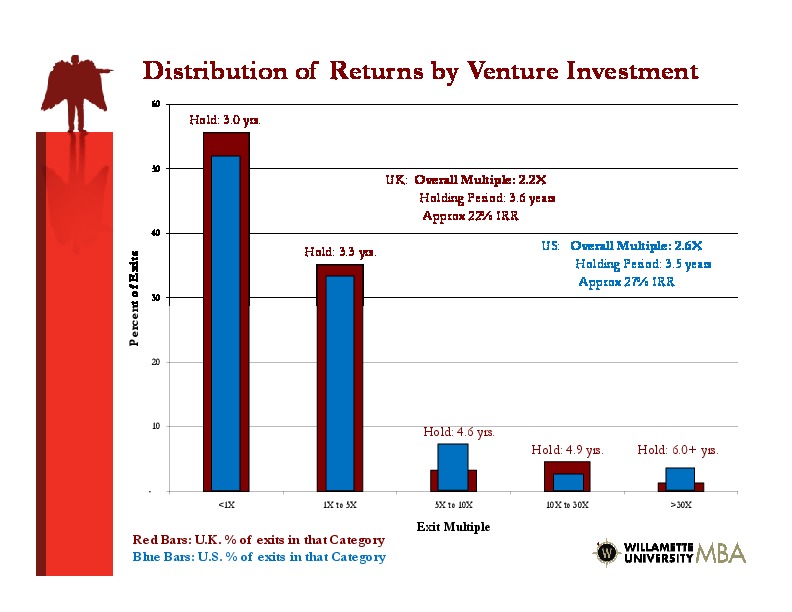

Popular Courses. Angel investors seem to bring more variety to the strategies in how they invest and build companies, relative to formal venture capital. In addition to those two practitioner reports, you can read a more formal academic paper on how entrepreneurial expertise influences the returns experienced by angel investors. Compare Investment Accounts. A zero-coupon bond may also appeal to an investor seeking to pass on wealth to his heirs. Another example is illustrated in the chart. Ready to get started? Large stocks underperformed between andposting a meager 1. Many people combat unsystematic risk by investing in exchange-traded funds or mutual funds, in lieu of individual stocks. While history tells us that equities can post stronger returns than other securities, long-term profitability requires risk management and rigid discipline to avoid pitfalls and periodic outliers. Risk Management. If you get the timing right and catch gold before a crisis, you might make a fortune. These findings line up with the fact that traders speculate on short-term trades in order to capture an adrenaline rush, over the prospect of winning big. The same could be said for new IPOs and stocks purchased solely because they look like a takeover target. We create personalized investment portfolios based on your finances and a gender-specific salary curve.

Comments

Post a Comment