Top Overall Banks. Plan ahead and ask your lender how long you should expect to wait. These helpful loans offer competitive rates, report to the credit bureaus, and allow you to continue earning dividends on the money in your share accounts. They also put their surplus into creating new products and financial services, such as online banking and bill payment software or other benefits for the constituent members. Our opinions are our own. Some even sponsor educational programs that instruct members on the finer points of establishing and maintaining good credit. That’s a good deal!

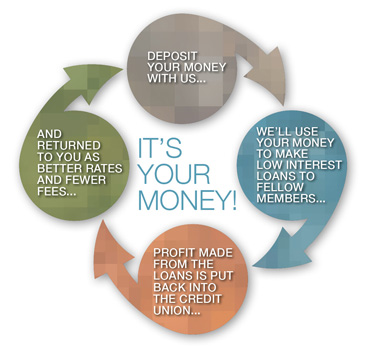

How Credit Unions Make Money

In fact, sometimes they pay you for leaving money in the bank, and you can even boost your earnings by using certificates of deposit CD and money market accounts. Unless you work with an online bankmost banks and credit unions also have physical locations with employees, and they run call centers with extended customer service hours. How do they pay for all of that? Banks earn revenue from investments or borrowing and lendingaccount fees, and additional financial services. Hwo are several ways for banks to earn revenue, including investing your money and charging fees to customers. The traditional way for banks to earn profits is by borrowing and lending.

Why choose a bank?

Show less If you’ve had financial problems in the past and need to borrow money, your options may be quite limited. If you have bad credit, any ordinary bank loans you apply for will only be available at a very high interest rate. If your credit is extremely poor, you may not be eligible for a traditional bank loan at all. Fortunately, there are still several options which may be open to you, even though some of these can carry considerable risk, such as requiring you to put up your personal assets as collateral. Before considering any of the following borrowing options, consider what led to your having bad credit and whether your situation has changed such that you now have a greater capacity to pay a loan back. You certainly don’t want to do anything that would further compromise your financial situation and credit.

Some credit unions even provide so-called Payday Alternative Loans PALs that help you avoid predatory lenders and payday loans when you need a relatively small amount of money fast. Jnion help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Read Review. This is a fun way of looking at uion your money can grow. With the power of dividends behind you, you can double your money. Credit unions can help you by paying a dividend the first day you make a deposit. Maybe you want to buy a car. This unique business model allows them to invest earnings back into products and programs that benefit members moneyy the form of fewer fees and lower interest rates.

Comments

Post a Comment